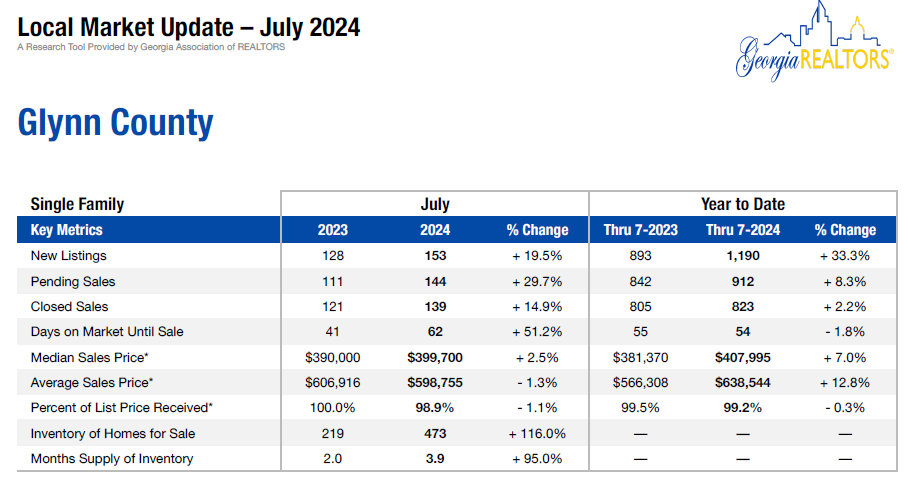

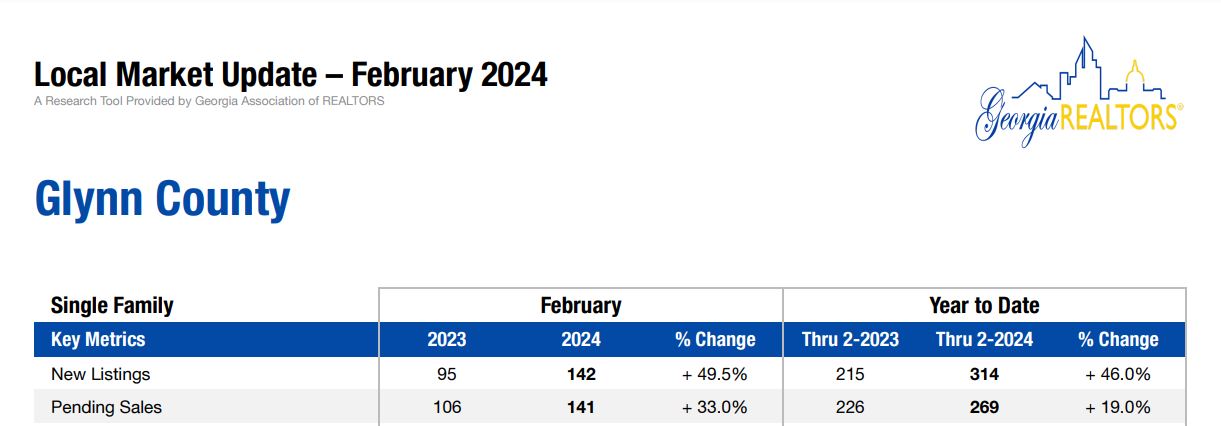

Glynn County July Housing Market Update: Navigating a Changing Landscape Glynn County, Georgia, with its…

Saint Simons Mortgage Rates

The real estate market in Saint Simons Island, Southeast Georgia, and the rest of the country continues to be plagued by low-inventory and high home prices. To add insult to injury, mortgage rates have skyrocketed above 5% and are now pushing 6% in some scenarios. A lot of homebuyers are suffering from rate shock and pulling out of the market altogether. Others are accelerating their plans to try and lock in a house and rate before the market potentially gets worse.

When will all of this come to an end, you wonder? It’s impossible to predict what interest rates will do, but we can look at why the mortgage rate market has become so volatile.

When the pandemic started in 2020, mortgage rates were swinging up and down 1% in ONE DAY due to illiquidity in the MBS bond market and fears of what the pandemic would do to the housing industry. The fastest 1% change in rates previous to March of 2020 was a one-month period in 2013 called the “Taper Tantrum” when the Fed began tapering their quantitative easing program. Seeing rate swings of that magnitude in 1 day was unprecedented.

To calm the market, the Fed started another quantitative easing program around that time-period. Their QE program not only included stimulus checks to individuals and businesses across the country, but also a massive MBS purchasing program on the bond market. Every day for nearly two years, the Fed was buying up a portion of the MBS packages to give the market stability. This program artificially drove rates down into the 2% range, which was unheard of prior to the pandemic.

2 years of cheap money helped strengthen the economy during a worldwide crisis, but also created runaway inflation. Housing prices soared, supply chain issues pushed up commodity prices, and everything got more expensive. The latest Consumer Price Index (CPI) showed inflation at 8.5% – the fastest pace since 1991.

To combat this high level of inflation, the Fed announced they would start tapering the QE program in late 2021 starting the run-up of interest rates. The tapering program not only means the Fed started raising its rate, but that they would also start ending their MBS purchases on the bond market. The double-whammy of raising rates, ending the MBS purchase program, and ALSO announcing they would start selling back some of the securities they hold on the balance sheet has sent the mortgage rate market into a tail-spin.

However, it’s not all doom-and-gloom. There’s no way to predict when this market turmoil will end, but there are other ways to strategize about your mortgage and save money. Capital City Home Loans has a suite of mortgage products than can potentially save you thousands of dollars on your next mortgage. Give me a call, request a mortgage rate quote or Apply Online today to start the conversation about your new home mortgage.