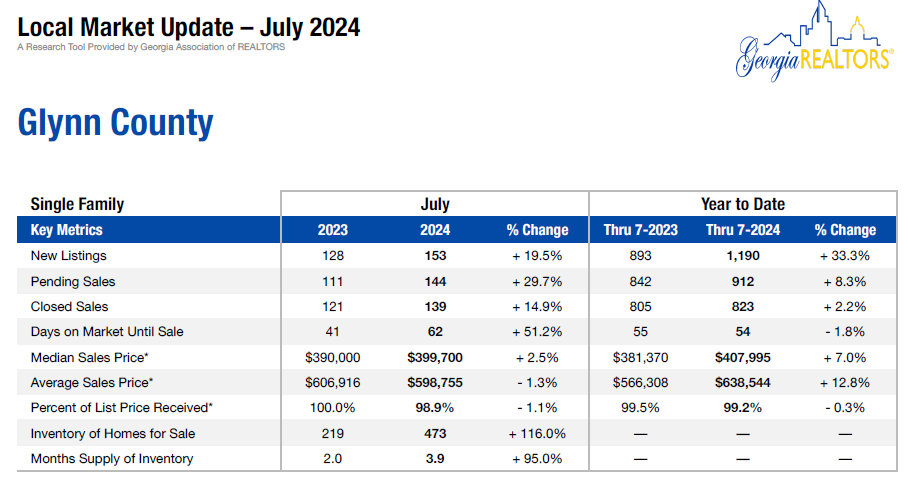

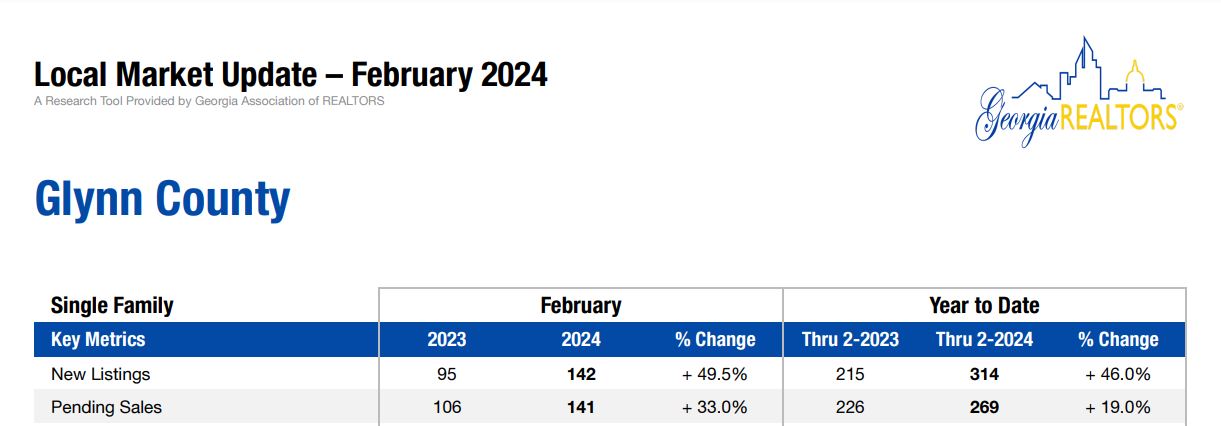

Glynn County July Housing Market Update: Navigating a Changing Landscape Glynn County, Georgia, with its…

Non-QM Mortgage Loans

Non-QM Mortgage Loans

After the mortgage crisis of 2008, several new laws were enacted to help keep such a crisis from ever occurring again. The biggest act was the Dodd-Frank Wall Street Reform and Consumer Protection Act. This act addressed many facets of the finance industry, and the mortgage industry was not excluded. This act created minimum standards for mortgages that are defined notably by the Ability to Repay (ATR) and Qualified Mortgage definition. Any loan that does meet those standards is considered a Non-QM Mortgage Loan.

This all sounds great in theory, but these standards are considered by many to be a government over-reaction. The QM rules leaves many qualified home-buyers out in the cold, so to speak. Many lenders have begun to originate these Non-QM Loans to serve those homebuyers that the big GSEs and Government mortgage markets aren’t.

These Non-QM loans are not sub-prime and not inherently high-risk. Many of these programs require large down payments, high credit scores, or a combination of both. They also allow for stated-income, recent derogatory credit events (i.e. – bankruptcy, foreclosure, DIL, etc.), longer loan terms, interest-only payments, and many other options.

These are normally loans that perform well and serve a set of customers that have been boxed out of the housing market.

Capital City Home Loans offers a great number of these programs through our niche investors. There are options for condotels, minimum 600 credit scores, qualifying with rental property cash-flow, loan amounts up to $3M, 40 year mortgages, closing in the name of an LLC or Corporation, and many other options.

If you have a unique situation and would like an analysis of what programs may suit your needs, contact me today or Apply Online. My team and I will help you find the right product for you that will help you achieve your financial and residential goals.